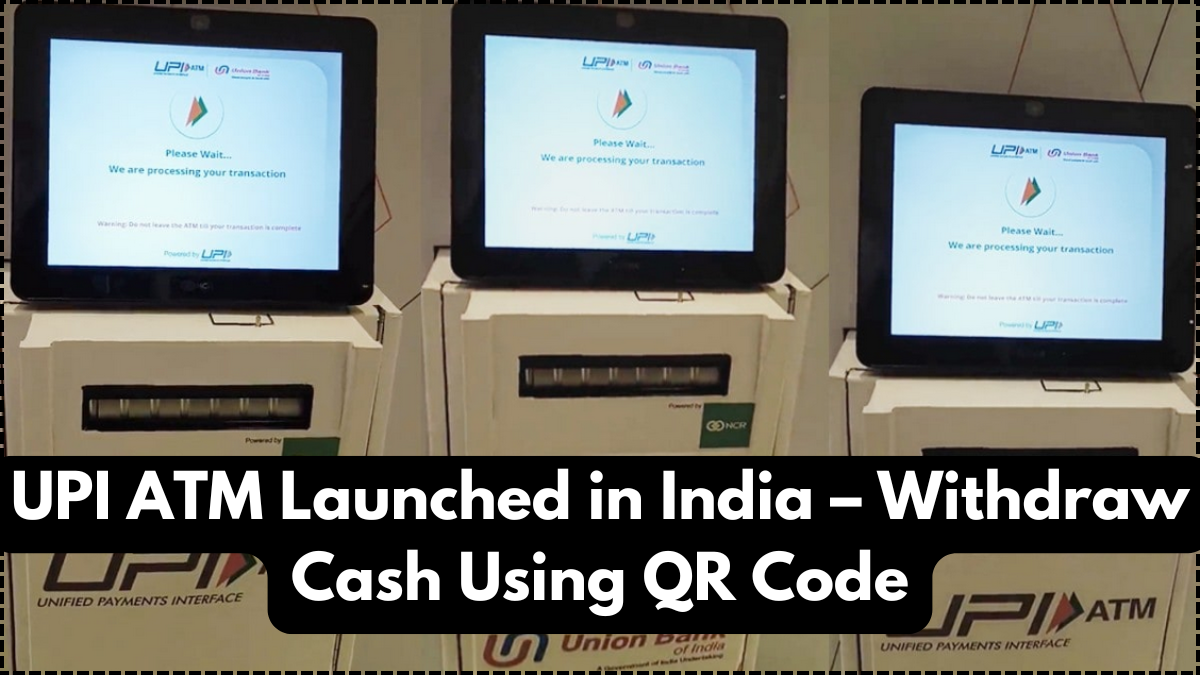

The long-awaited UPI ATM rollout India has finally begun, changing how millions of people access cash. This innovative system allows users to withdraw cash from ATMs using their smartphones instead of a debit card. By merging UPI’s instant payment system with ATM infrastructure, India is setting a new global benchmark for cash access and digital finance.

The launch is part of the country’s broader mission to expand digital payments while still offering cash options for those who need it. With the withdraw via QR code feature, cardless ATM transactions will become faster, safer, and more convenient.

Why the UPI ATM rollout India is a Big Deal

The UPI ATM rollout India is more than a technological upgrade—it’s a shift in how banking services are delivered. Traditionally, cash withdrawals depended on cards and PINs, but this new system replaces that with UPI-powered QR scanning.

By using the withdraw via QR code method, customers can avoid issues like lost cards, skimming fraud, and ATM PIN theft. This step is a natural evolution for UPI, which has already transformed payments for shopping, bill payments, and peer-to-peer transfers.

How the UPI ATM withdrawal process works

The system behind the UPI ATM rollout India is designed to be simple for users. Here’s how the transaction works step by step:

-

Visit an enabled ATM with the new UPI option

-

Select the “UPI Cash Withdrawal” option on the screen

-

Scan the displayed QR code using any UPI app (like PhonePe, Google Pay, or Paytm)

-

Enter the amount you wish to withdraw in the UPI app

-

Authorize with your UPI PIN and collect cash instantly

This withdraw via QR code system reduces dependency on cards and makes withdrawals faster for tech-savvy users.

UPI ATM rollout India – Availability and Limits

Banks and ATM operators have provided details about where the new service is active and how much cash can be withdrawn.

| Bank/ATM Operator | Availability Start Date | Daily Withdrawal Limit |

|---|---|---|

| State Bank of India | August 2025 | ₹5,000 per day |

| HDFC Bank | August 2025 | ₹5,000 per day |

| ICICI Bank | September 2025 | ₹5,000 per day |

This table shows that the UPI ATM rollout India will start gradually across major banks, and for now, the withdraw via QR code feature has a modest daily limit to ensure system stability during the initial phase.

Benefits of the UPI ATM rollout India

The new system brings multiple advantages for customers and banks alike:

-

Card-free convenience: No need to carry or replace physical debit cards

-

Improved security: Withdraw via QR code eliminates card skimming risks

-

Faster transactions: No PIN entry at the ATM, only UPI PIN in the app

-

Financial inclusion: Easy access for people who rely on UPI but don’t have cards

By reducing reliance on cards, the UPI ATM rollout India also cuts costs for banks, as fewer plastic cards will need to be issued and replaced.

Conclusion

The UPI ATM rollout India is a landmark innovation that blends the country’s digital payments success with traditional cash access needs. By letting users withdraw via QR code, this feature makes ATMs safer, faster, and more convenient. As banks expand the rollout, millions of Indians will enjoy a new, cardless way to manage their money.

FAQs

What is the UPI ATM rollout India?

It’s a new system that allows ATM cash withdrawals using UPI apps instead of debit cards.

How does the withdraw via QR code work?

Users scan a QR code on the ATM screen with their UPI app, enter the amount, and approve the transaction with their UPI PIN.

Is there a fee for using the UPI ATM feature?

Currently, banks have not announced extra charges for withdraw via QR code transactions during the rollout phase.

What is the withdrawal limit for UPI ATM transactions?

Most banks are starting with a ₹5,000 per day limit for the UPI ATM rollout India feature.

Can all UPI apps be used for this service?

Yes, any UPI-enabled app that supports QR payments can be used for these withdrawals.

Click here to learn more